“…the FOMC believes that–for now–the best way forward is to keep gradually raising the federal funds rate. We are aware that, on the one hand, raising interest rates too slowly may lead to high inflation or financial market excesses. On the other hand, if we raise rates too rapidly, the economy could weaken and inflation could run persistently below our objective. The Committee will continue to weigh a wide range of relevant information when deciding what monetary policy will be appropriate. As always, our actions will depend on the economic outlook, which may change as we receive new data.” ~Chairman Jerome Powell, Federal Reserve, July 17, 2018

“In many ways, bond investors have been guinea pigs over the last 10 years of QE. They were part of a massive experiment, one in which central banks expanded balance sheets to provide liquidity to the market and have ended up owning more than 20 per cent of outstanding global bonds. ” ~Andres Sanchez Balcazar, Pictet Asset Management

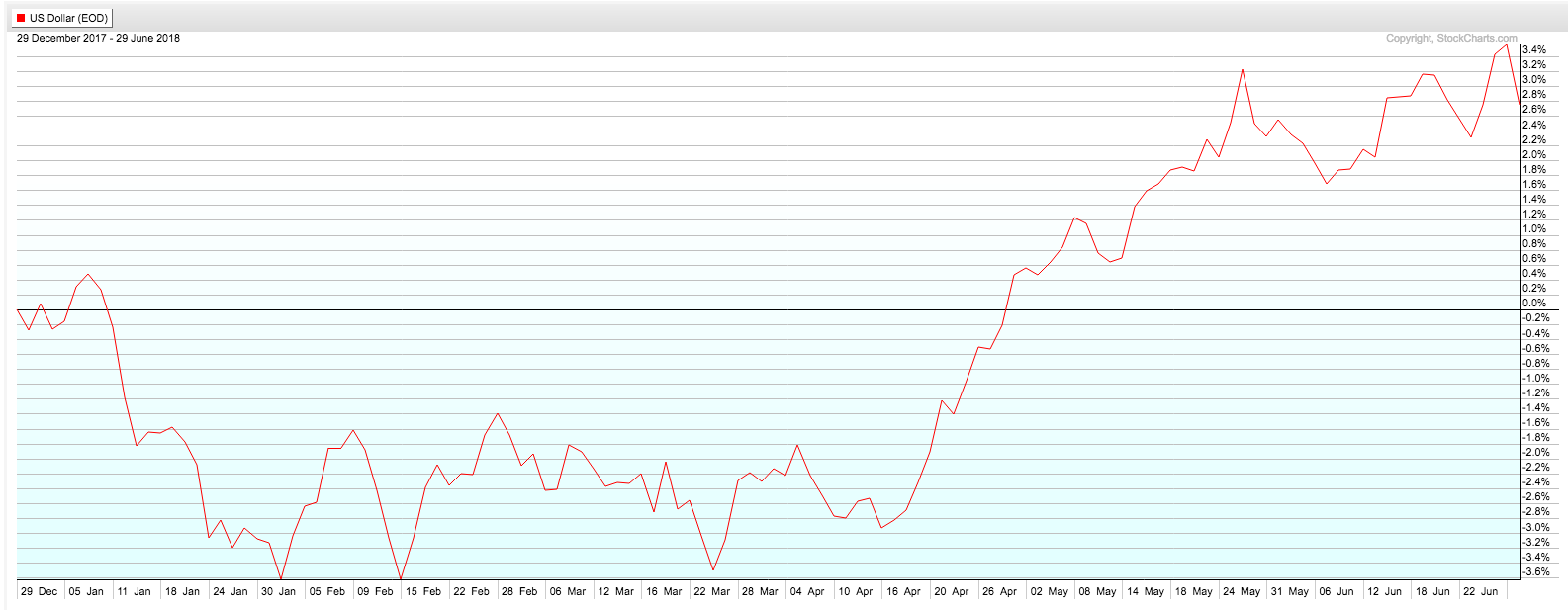

U.S. Dollar Index

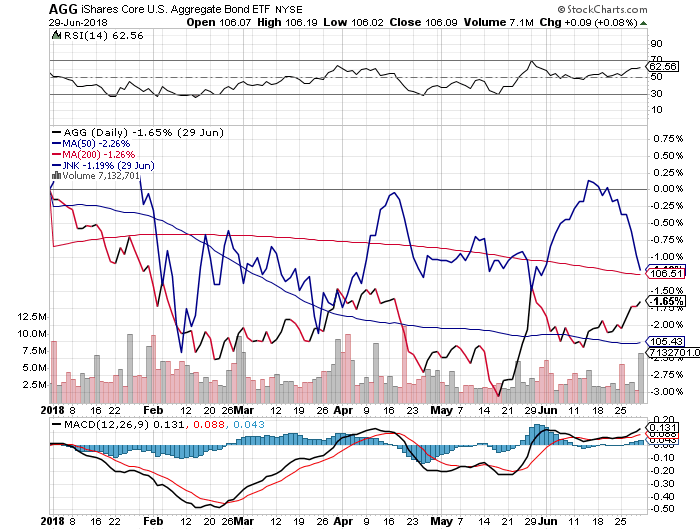

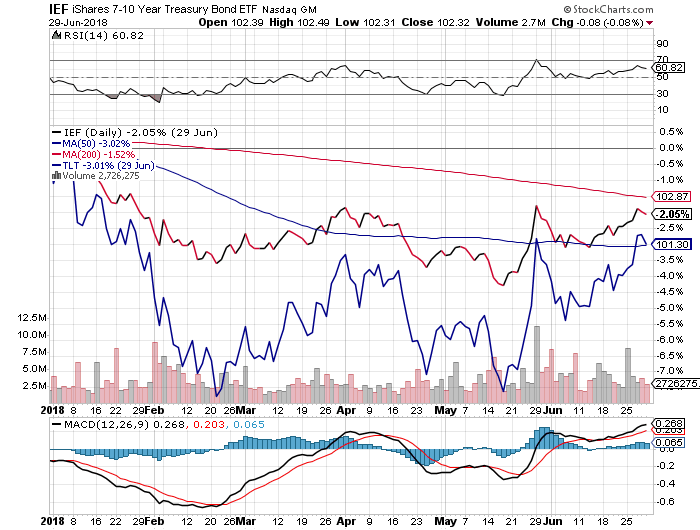

Fixed Income

U.S. Bond Aggregate (AGG), High Yield Bond ETF (JNK)

5-7yr. Treasury ETF (IEF), 20 yr. + Treasury ETF (TLT)

Be the first to comment