“It provides companies with access to cheap capital. And it offers virtually everyone in society an affordable and straightforward way to acquire a stake in human ingenuity. As a mechanism for lifting economic growth and democratising finance, the stock market has few genuine rivals. But the listed company’s unique status in the world of investment is being contested. The challenge comes from privately held firms, which account for an ever bigger slice of the economy. This is particularly true of the US. Although the total number of US companies has remained relatively steady in recent decades, fewer of them are publicly traded. As a percentage of all US firms, the proportion of listed companies has fallen by more than half since peaking in 1996. If this trend continues, it could make equity investing more complicated and costly for all but the wealthiest and largest investors. It could make equity investment riskier too.” ~ Pictet Asset Management, Secular Outlook, 2018

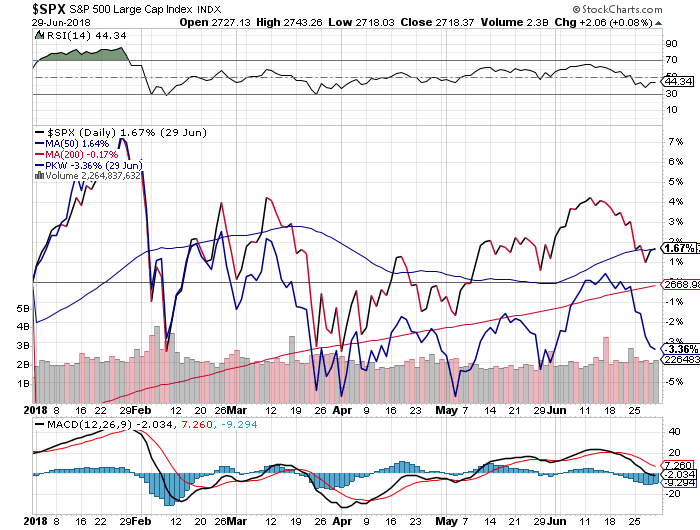

S&P Large Caps (SPX), Buybacks (PKW)

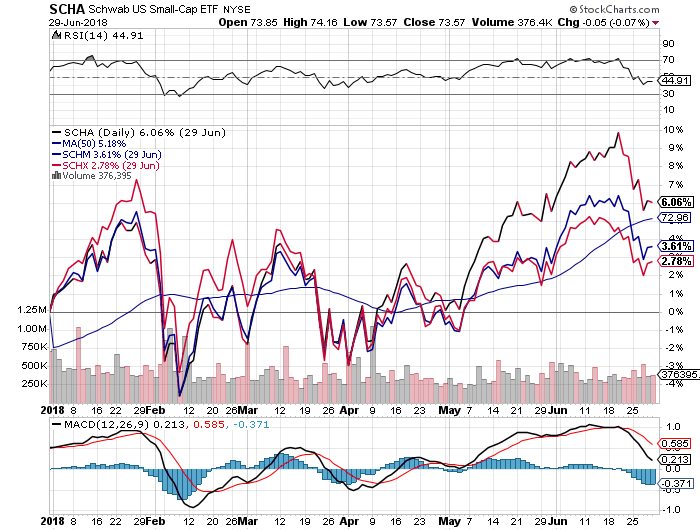

U.S. Small Caps (SCHA), U.S. Mid Caps (SCHM), U.S. Large Caps (SCHX)

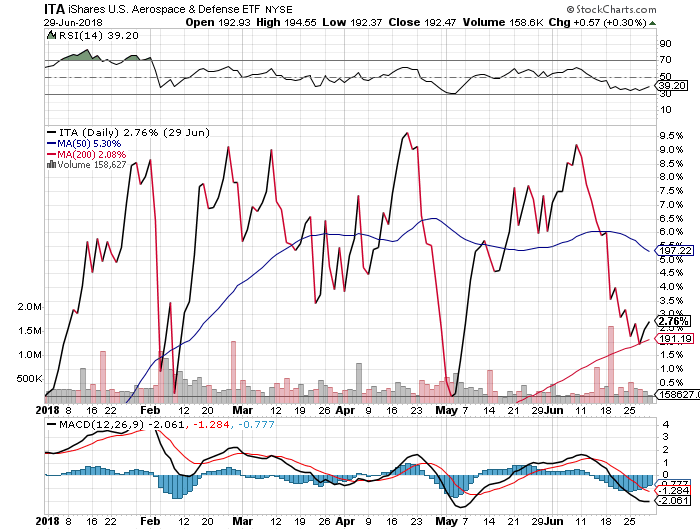

U.S. Aerospace & Defense (ITA)

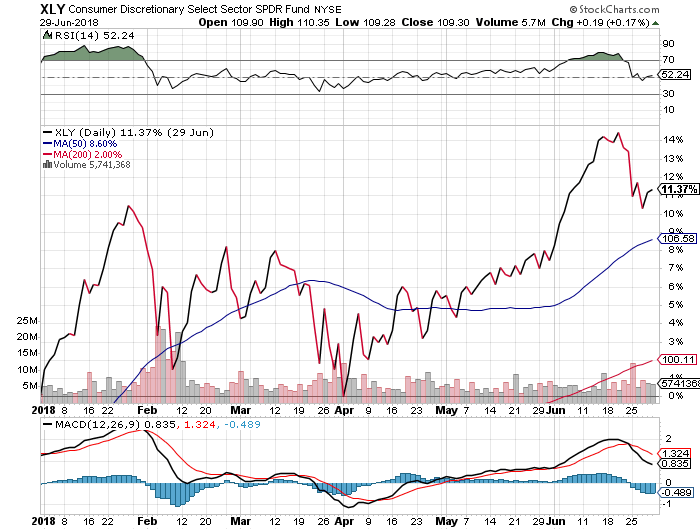

Consumer Discretionary (XLY)

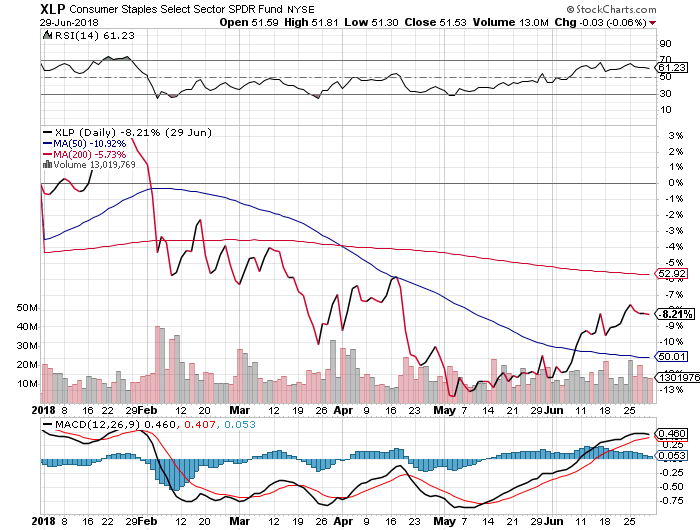

Consumer Staples (XLP)

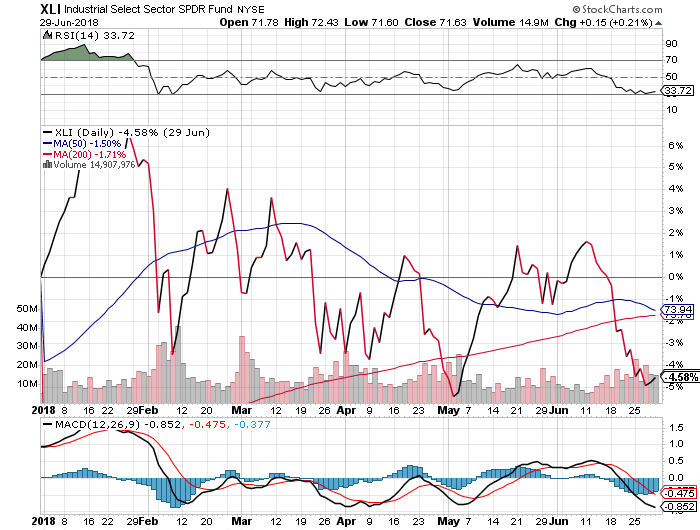

Industrial Select (XLI)

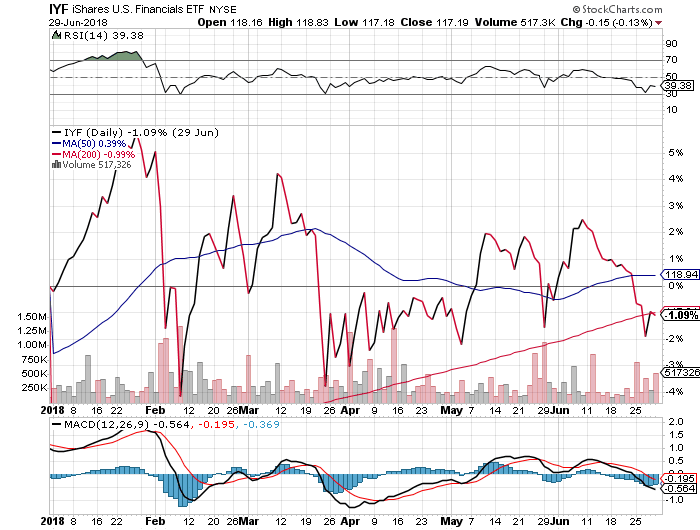

U.S. Financials ETF (IYF)

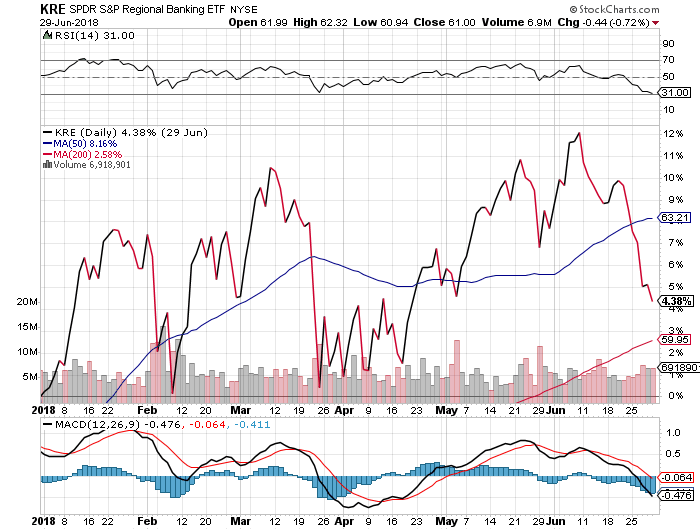

S&P Regional Banking (KRE)

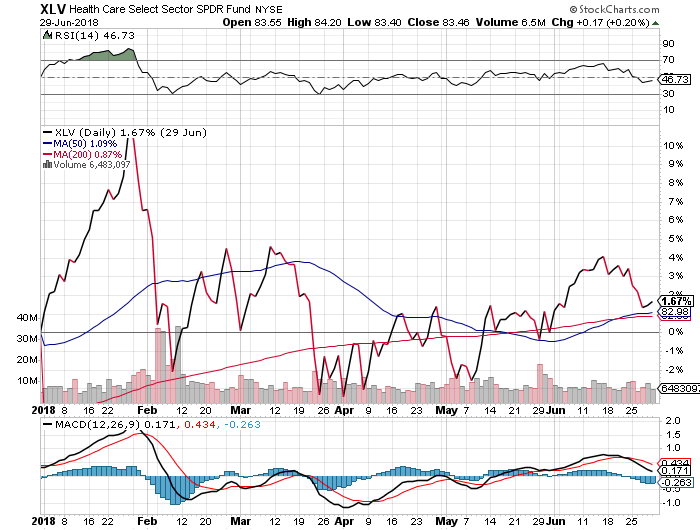

Health Care (XLV)

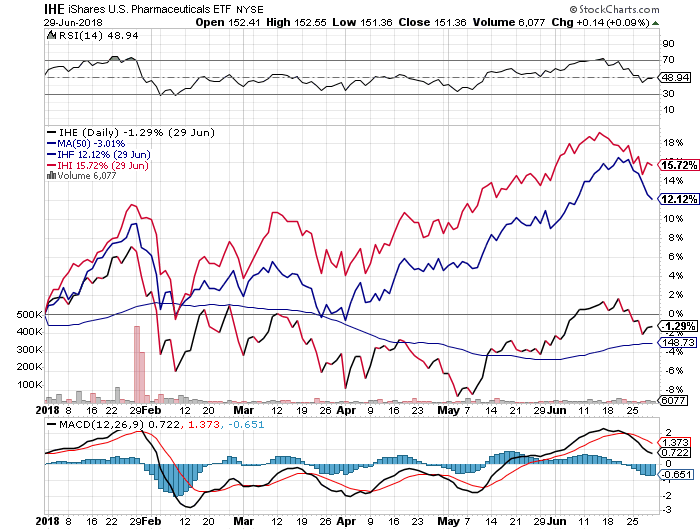

U.S. Pharmaceuticals

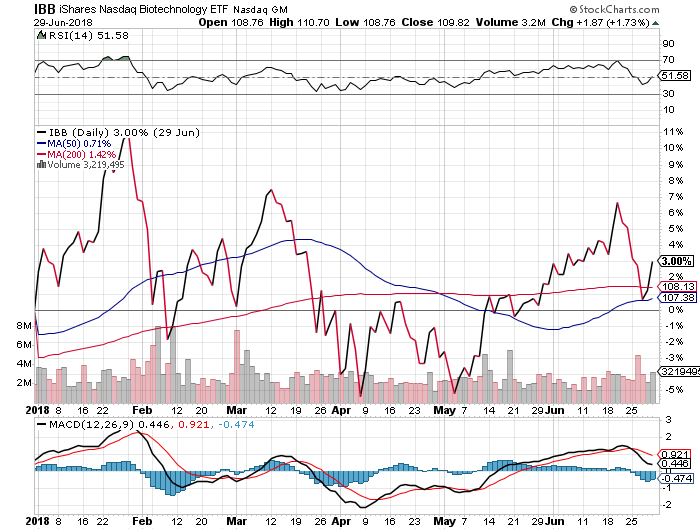

Biotech (IBB)

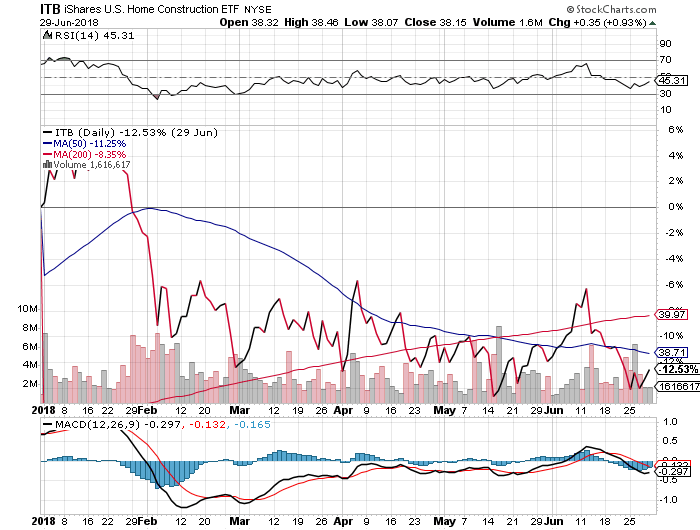

U.S. Home Construction (ITB)

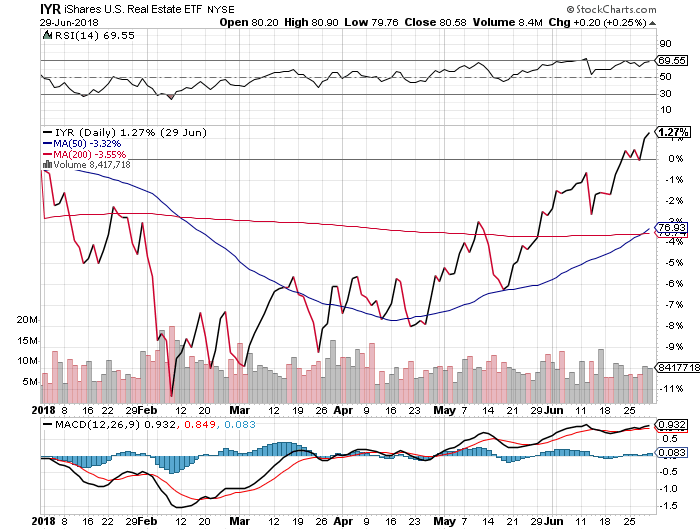

U.S. Real Estate (IYR)

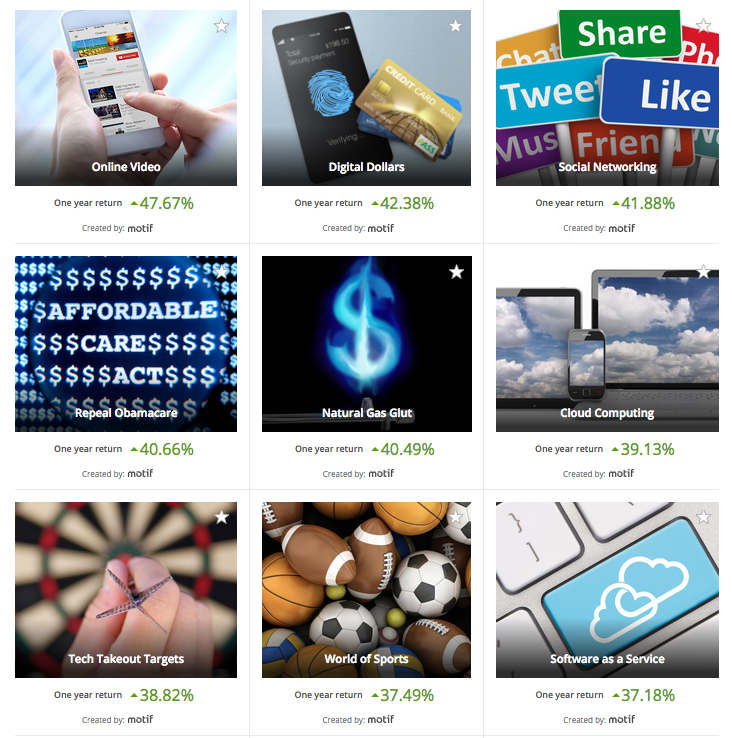

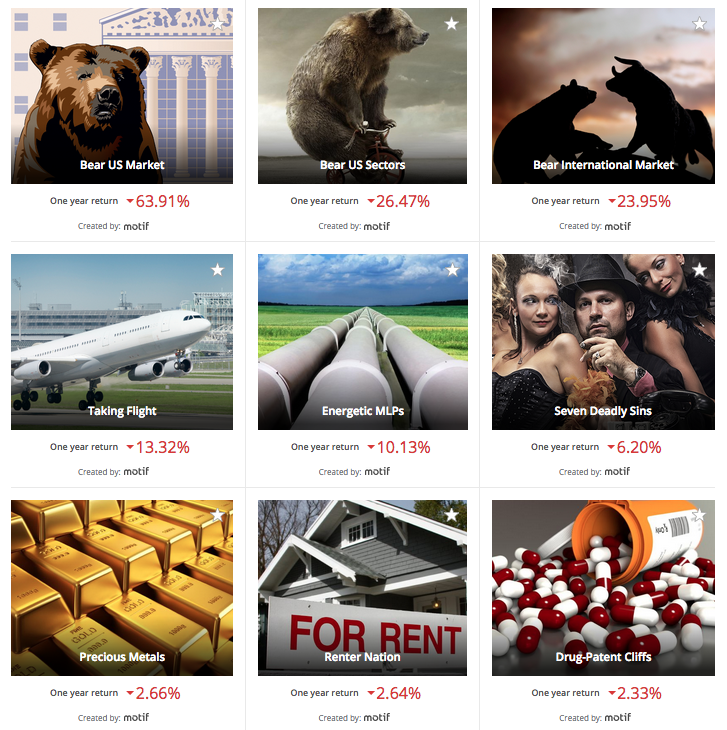

Motif Investing: Highest Earners (1-Year Returns)

Motif Investing: Lowest Earners (1-Year Returns)

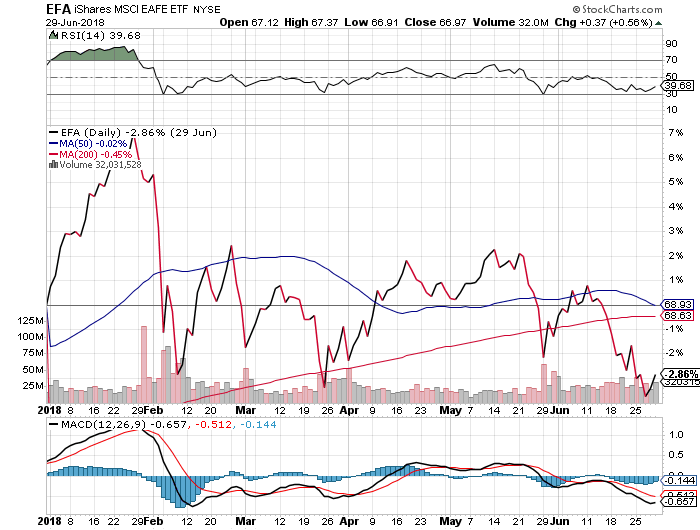

International Developed (EFA)

Europe

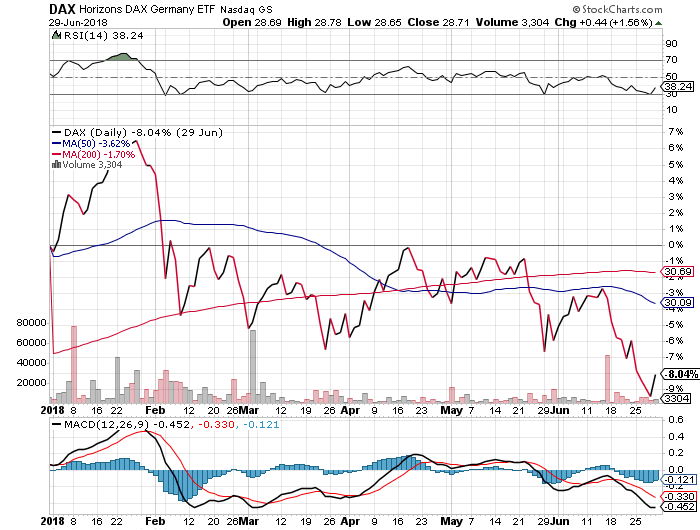

Germany (DAX)

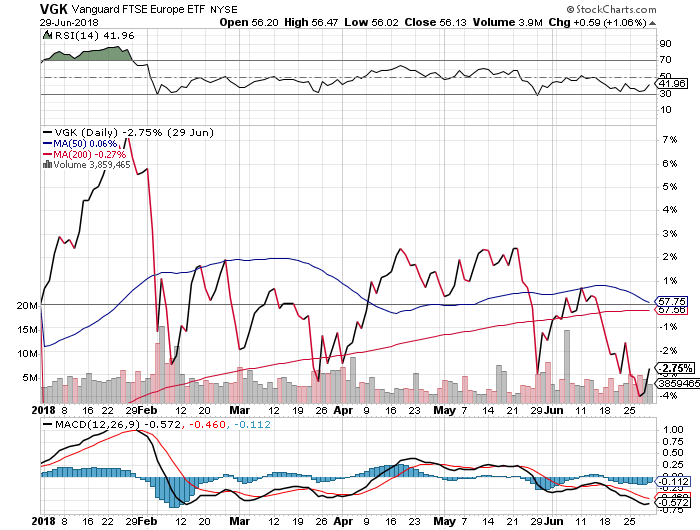

FTSE (VGK)

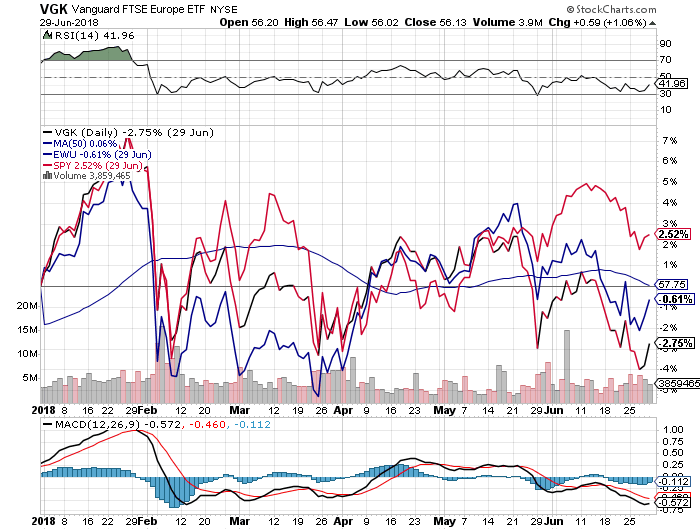

VGK (FTSE), EWU (UK), SPY (S&P)

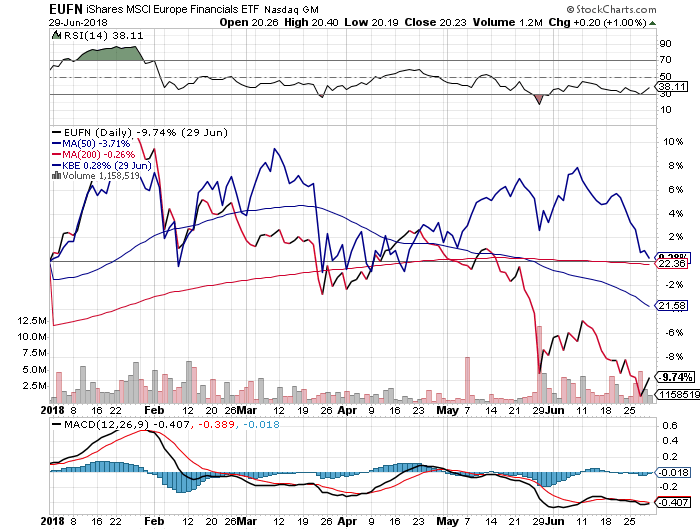

European Financials (EUFN), U.S. Financials (KBE)

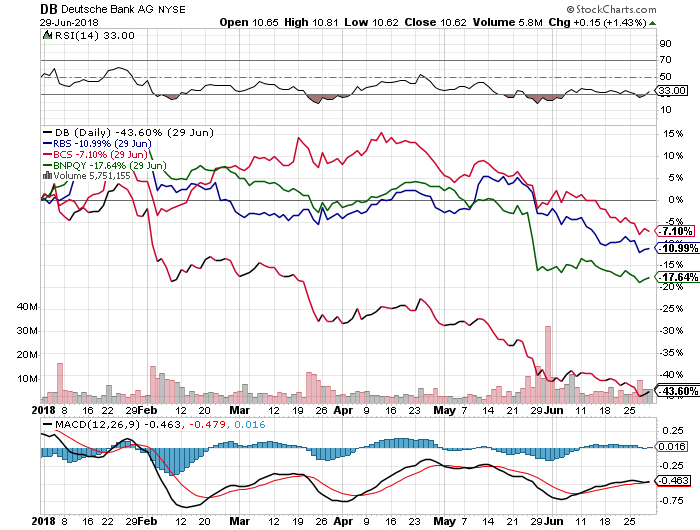

European Financials: Deutsche Bank (DB), Royal Bank of Scotland (RBS), Barclays (BCS), Paribas (BNPQY)

Asia

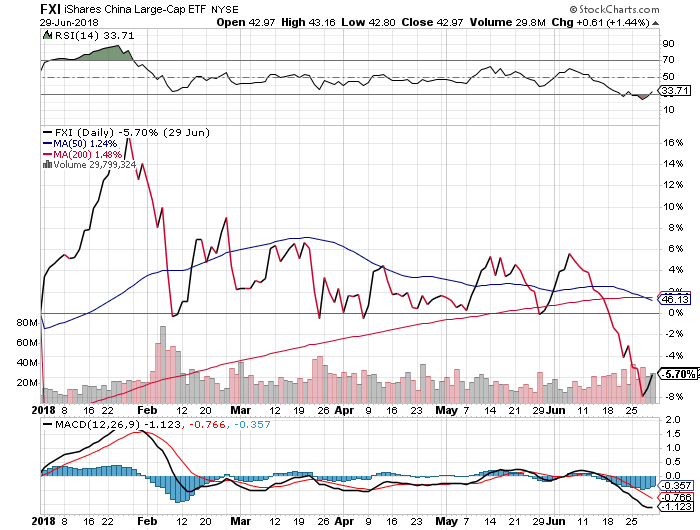

China Large Caps (FXI)

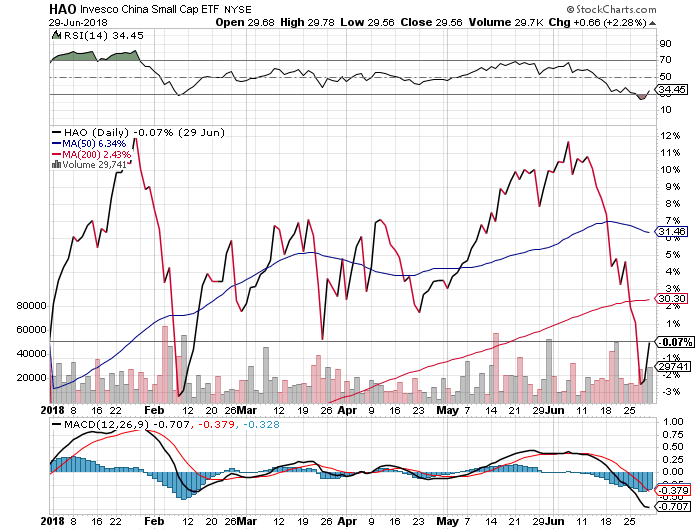

China Small Caps (HAO)

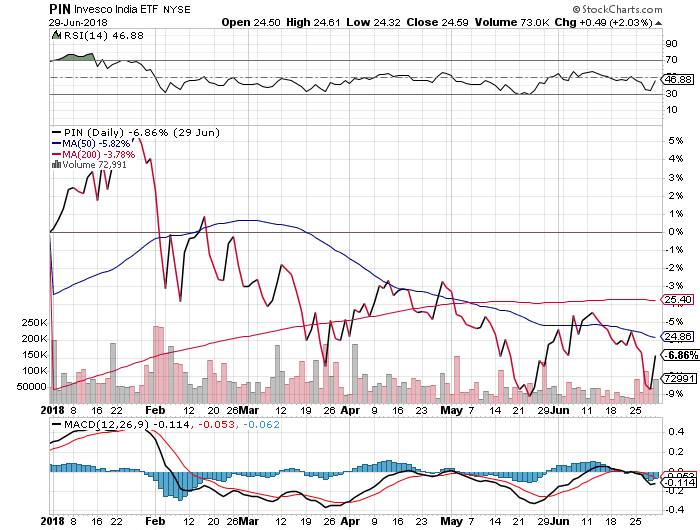

India (PIN)

Emerging Markets

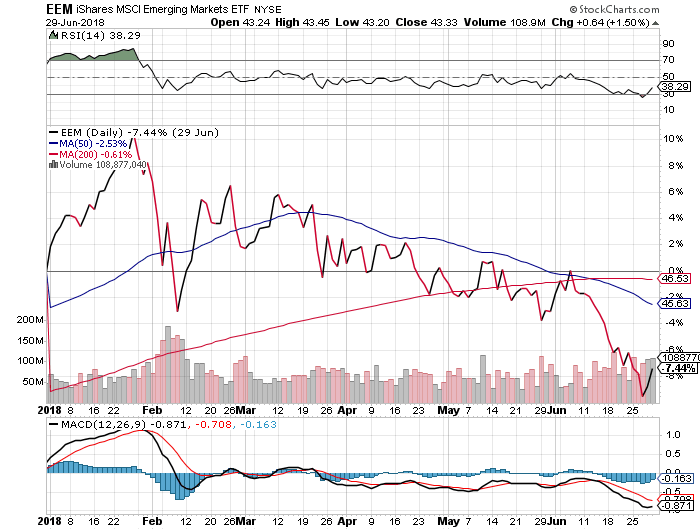

Emerging Markets (EEM)

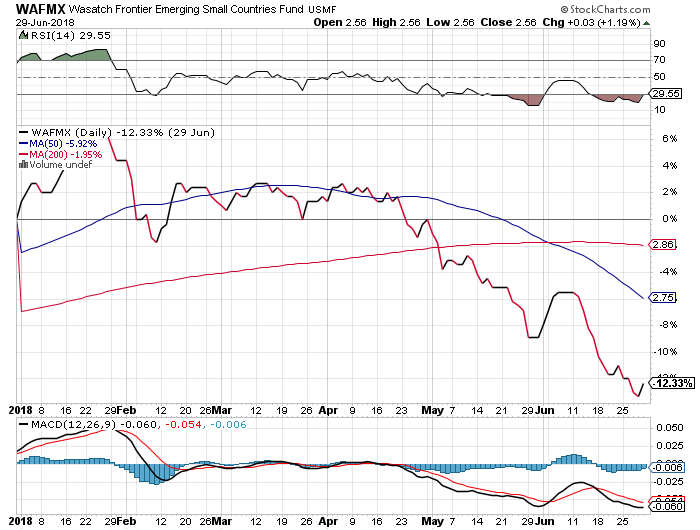

Frontier Markets (WAFMX)

Be the first to comment